New York City, New York Feb 20, 2026 (Issuewire.com) - EsportsRanker releases comprehensive data revealing the generational dynamics reshaping the esports wagering landscape in 2025-2026. As the market surges past $2.8 billion globally, Gen Z and Millennials are driving unprecedented growth, with distinct participation patterns and behaviors emerging between these digital-native generations. This analysis examines how these cohorts are transforming esports betting from a niche activity into a mainstream entertainment phenomenon across regulated markets worldwide.

Key Takeaways:

- Explosive Market Growth: Global esports betting revenue reached $2.5 billion in 2024, is projected at $2.8 billion for 2025, and is on track to surpass $3 billion by 2026, representing 12% year-over-year growth as the user base expanded from 21.9 million (2017) to 74.3 million (2024).

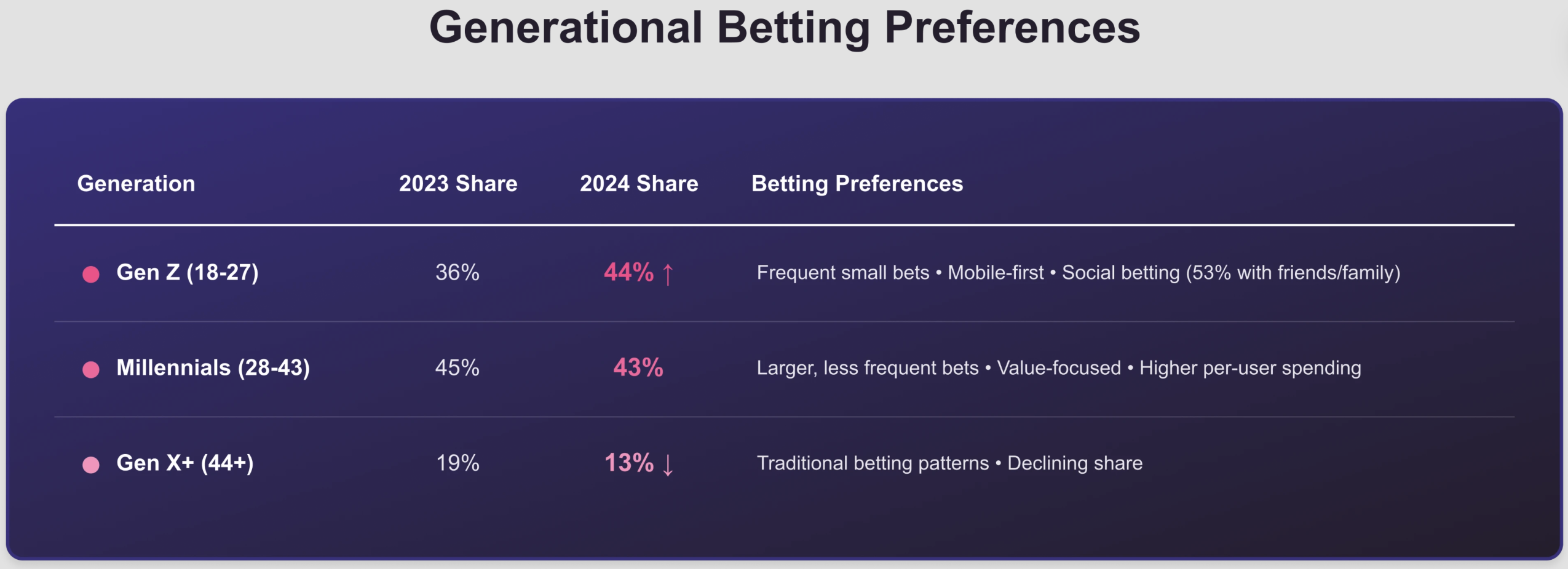

- Gen Z Dominance Emerging: Gen Z bettors (ages 18-27) now comprise 44% of the market in 2024, up from 36% in 2023, while Millennials (ages 28-43) account for 43-44%, with these two generations together representing 87-89% of all esports bettors globally.

- Contrasting Betting Behaviors: Gen Z favors mobile-first, high-frequency micro-betting with strong social components (53% bet with friends/family), while Millennials place larger individual wagers with higher per-capita spending, contributing disproportionate revenue despite similar participation numbers.

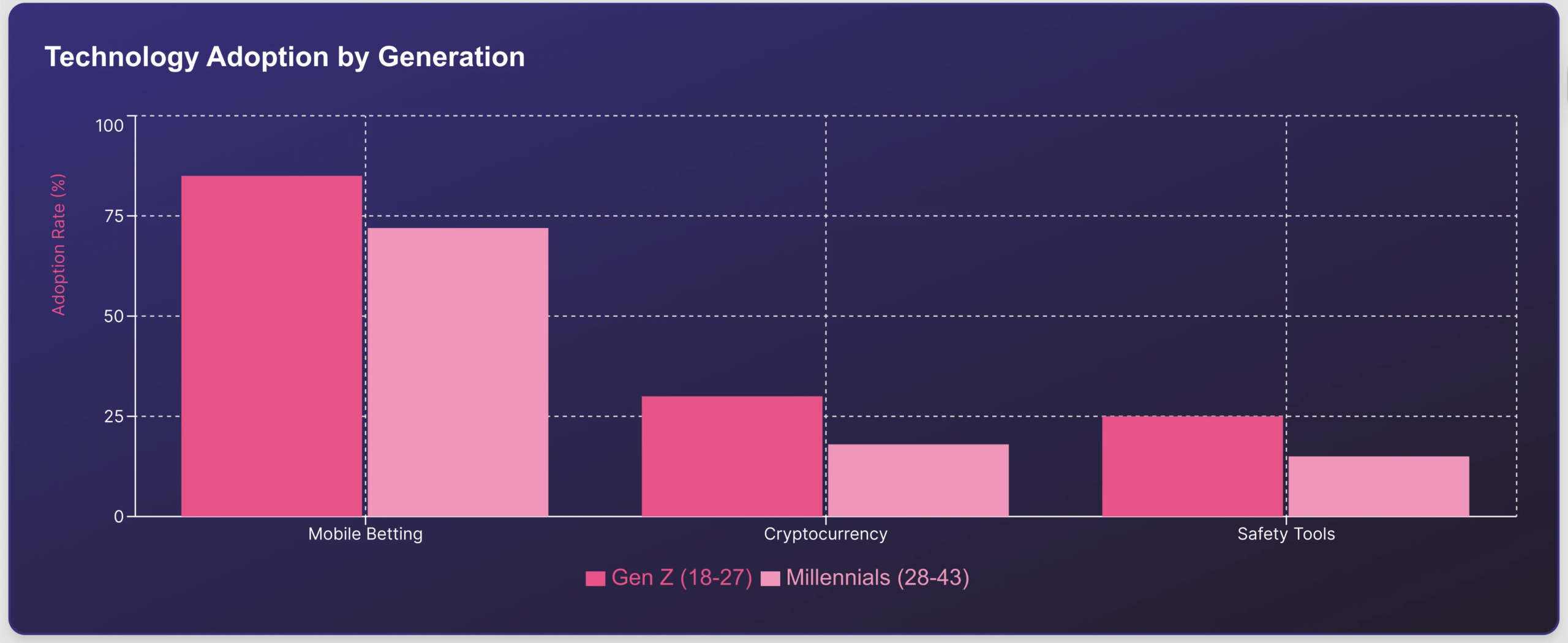

- Mobile and Technology Adoption: Approximately 70-80% of all esports bets are placed via mobile devices, with Gen Z leading in cryptocurrency adoption, fintech integration, and responsible gambling tool usage (25% utilization rate).

- European Market Leadership: Europe's under-25 betting segment is growing at 8%+ CAGR through 2031, with the UK commanding 25% of European online gambling revenue as regulated markets successfully transition young bettors from grey-market platforms to licensed operators.

The industry has grown quickly. It moved from grey-market skin betting to a legal, billion-dollar business. Revenue rose from $2.5 billion in 2024 to an expected $2.8 billion in 2025 and should pass $3 billion by 2026. User numbers also jumped, growing from about 22 million in 2017 to over 74 million in 2024. Games like Counter-Strike, League of Legends, and Valorant drive most betting activity. Expanded regulation in Europe and the U.S. pushed users toward licensed platforms with age checks and consumer protections, making esports betting more accepted among young adults.

Esports betting is heavily driven by younger users. In 2024, Gen Z players aged 1827 made up about 44% of users, up from 36% a year earlier. Millennials accounted for another 4344%. Together, they represent close to 90% of the market, while only a small share is over 44. Surveys show that most esports bettors are under 30. Gen Z is growing the fastest and is expected to become the largest group by 20252026 as more reach legal age.

The two generations also bet differently. Gen Z places smaller bets more often and prefers live or micro-betting. Millennials usually place larger bets, helped by higher income. The average esports wager is around 29. Most bets from both groups are placed on mobile phones, with Gen Z leading mobile use. Gen Z is also more social, often betting with friends, and more likely to use crypto payments and responsible gambling tools.

Europe highlights these trends clearly. The UK makes up about 25% of Europes online gambling revenue in 2025. While users aged 2540 still dominate overall gambling, under-25 bettors are the fastest-growing group. Esports attracts younger users than traditional betting products, pushing operators to adjust their platforms. As Gen Z grows and Millennials keep spending more per user, esports betting is set to remain one of the fastest-growing gambling segments.

To explore the full analysis and deeper insights behind these trends, visit the EsportsRanker blog for the complete report.

About CasinoRank:

More On Bestofnewsupdates ::

- Flux AI Secures Strategic Investment from Southpole Ltd.

- Future Leading Ammonia Cracking Hydrogen Production Services: ALLY Showcasing Innovation at TSEE

- Bridging Innovation and Integrity: Matt Egyhazy on Redefining the Role of Technology Leadership in Modern Banking

- Hong Kong International Automotive - Supply Chain Expo Kicks Off

- Andreas Szakacs AI Roles Drive Career Growth - Red Carpet Rise

CasinoRank is a global iGaming affiliate brand focused on rating and ranking online gambling platforms. Launched in 2016, CasinoRank operates across multiple verticals, including OnlineCasinoRank, LiveCasinoRank, and EsportsRanker.

Source :CasinoRank

This article was originally published by IssueWire. Read the original article here.